Top Cost Factors of Custom Metal Forging Parts: What Really Drives the Price?

I see buyers chase tonnage quotes and still miss budget. That hurts. Costs hide in yield loss and risk across the line, not in a simple press-hour number.

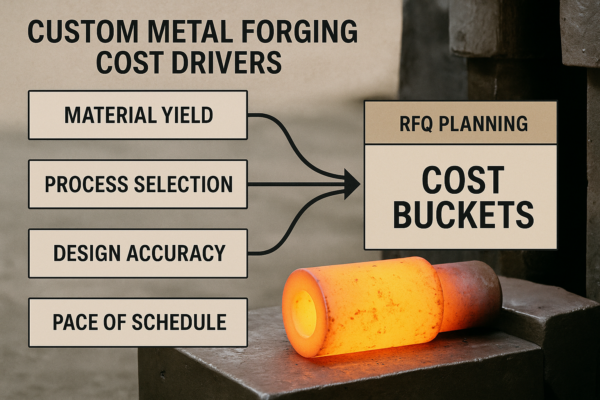

The real price of custom metal forgings comes from yield and risk across material, process, design, and schedule; if I control buy-to-fly, grain flow, tolerances, and cadence, my piece price drops and delivery holds.

I wrote this to help you get to a clean RFQ and a firm quote without three rounds of confusion; if you want to act while you read, send your print on Prime Custom Parts via the Contact page and keep this guide open as your checklist.

Material Selection: How Steel, Stainless, and Alloys Shape the Final Cost?

You can pick a grade in five minutes and still add weeks of pain; alloy choice sets heat, scale, and yield, and that sets real cost more than press tonnage ever will.

Material cost is not just alloy price per kilogram; nickel and moly raise base price, but billet diameter, reduction ratio, and scale loss set buy-to-fly yield and total spend, so I size the billet before I chase the tonnage rate.

I price material on two lines—the invoice price per kilogram and the kilograms I must buy to ship one good part—and that second line is the buy-to-fly ratio I insist on putting in every quote, because ASM International shows clearly in its bulk forming handbooks why hotter alloys run longer and grow more scale, while the Forging Industry Association explains how stock choice and preform shape change flash and trim the same way a better hopper changes flow in a die; inside our own shop notes on Metal Forgings I document how stainless and nickel grades lift furnace time and lube demand, so I warn buyers early that higher alloy content often hits them twice—once on the raw material and again on yield.

Dive deeper

I aim for a 3:1 reduction ratio on general parts and 4:1–6:1 on fatigue-critical parts, because a lazy billet with low work leaves the grain flat and the life short, and when I write the RFQ I anchor NDT gates with public words from ASTM—I use ASTM A388 for UT on steel forgings and ASTM E1444 for MT on ferromagnetic steels—so no one argues later about what “sound” means; when the assembly has mixed metals or corrosion exposure, I point the team to NIST Manufacturing for fundamentals and then back to our Blog where I keep simple stock-loss examples that any buyer can run before a supplier sees the RFQ.

Quick yield example. I take a 10 kg finished part, I plan a 20 kg billet, I add 2 kg of flash/trim, I expect 0.6 kg of scale on carbon steel or 1.6 kg on stainless, and I keep 1.4 kg of machining stock; my carbon BTF lands near 2.4:1 and my stainless BTF near 2.5:1, which is why I write “assumed BTF” into the notes on Contact when I ask a new shop to quote, and if a manager needs a shareable explainer I send the FIA Forging 101 primer and the forging chapter pointers in ASM with a single line about how scale and decarb make surface conditioning—peel, grind, or blast—non-negotiable on hot work.

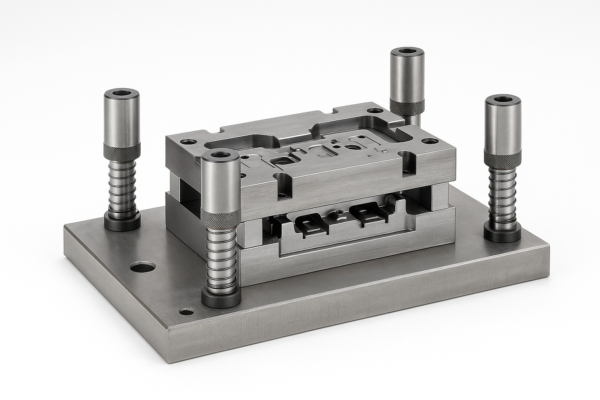

Forging Process & Tooling: Open-Die, Closed-Die, and Hot vs. Cold Forging?

You can save on dies and pay on press time, or you can buy dies and win on cycle; I choose the route by geometry, alloy, tolerance, and volume, and I prove it with a break-even.

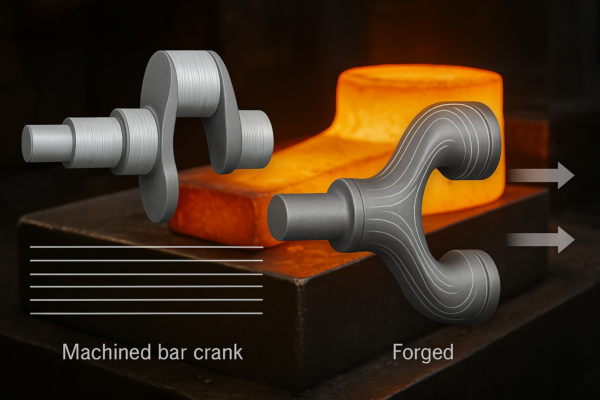

Open-die saves tooling and starts fast but pays in machining stock; closed-die adds dies and gives near-net shape and shorter cycles; hot forging is flexible; cold forging adds tonnage and lube but cuts post-machining when the alloy and shape allow.

I like open-die for long shafts, rings, and blocks in low counts because I can start in days and keep the core sound, yet I warn buyers that the chip bin will be heavy, while I pitch closed-die when ribs, pockets, or grain-flow around bosses matter because the cavity, the preform, and the draft do the work that a mill would do later; for people who want pictures I use the design notes and case sketches from FIA in the kickoff deck, and for engineers who want the physics I send them back to forming curves in ASM beside our in-house tracker on Metal Forgings so no one forgets that lube and die temperature change fill and die life more than a tidy CAD model ever will.

Dive deeper

I set draft at 3–7 degrees on hot closed-die surfaces because near-zero draft looks slick in CAD and terrible on the press, and when a team pushes back I open the Design Engineering Center pages and I circle the sketch that shows galling and underfill as draft falls; I also remind planners that cold forging only belongs when the alloy can move and the press can carry the work, because while the per-piece hours drop, the tonnage, the lube chemistry, and the tool life plan climb, which is why I frame cold work as a high-volume route with a real NRE and I tag ASCM in my notes when I map the volume to a release plan so purchasing understands why the die pays back only after a certain count.

A one-line break-even keeps the meeting short: if total die cost is \$18,000 and my per-piece savings vs open-die is \$45, I break even at ~400 pieces, so if the two-year plan is 1,200 pieces I tell the room to stop debating and cut the die, and if someone needs a process sanity check I point them to the public pages at FIA and the shop notes on Metal Forgings with the same message.

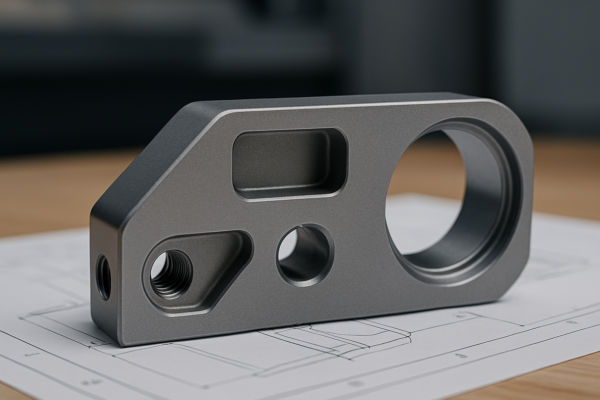

Design Complexity & Precision Requirements: The Impact of Tolerances and Post-Machining?

A clean model can hide hard work; tight limits add hits, stock, straightening, and checks, and those hours roll straight into your unit price.

Tight tolerances and sharp features raise cost quickly; generous radii, realistic drafts, clear datums, and stock zoning cut machining and scrap without risking function, and the inspection plan must match the failure you fear.

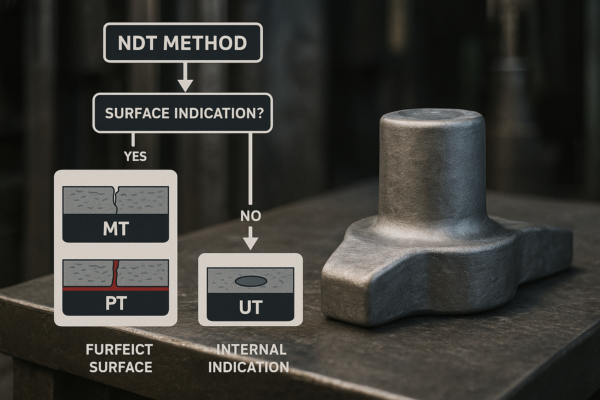

I push internal radii because grain wants to flow and laps kill parts, and when a team tries to land datums on curved or discontinuous surfaces I send them the same quick paragraph from FIA and then I mark the print in our Blog with a stock-zoning overlay so the machinist can see where the cutter actually touches the part; when we pick NDT I tie the method to the risk and anchor the words with links to ASTM so that ASTM A388 covers UT inside thick steel forgings, ASTM E1444 covers MT on ferromagnetic steels, and penetrant from the same ASTM index covers austenitic stainless and non-magnetic alloys without inventing new acceptance levels.

Rule-of-thumb band. I hold ±1.0–1.5 mm on hot-forged carbon or alloy steel below 100 mm, I move to ±1.5–2.5 mm up to 300 mm, and I plan more move on stainless and nickel hot forgings, while cold-forged steel can sit in the ±0.1–0.3 mm range on the right features; if you need the functional faces tight and the rest clean, tell me that when you send the print on Contact so I can zone stock and skip an extra setup.

Order Volume & Lead Time: Why Batch Size and Delivery Schedule Matter?

One small batch can cost like three big ones, because partial loads waste furnace space, press windows break, and inspection loses efficiency when you split runs.

Bigger batches amortize dies and setups, fill heat-treat loads, and ride existing press windows; expedites break cadence and pull overtime, so I expect premiums if delivery must move left on the calendar.

I plan releases with a simple Economic Order Quantity check so purchasing sees the curve between order cost and holding cost, and I link that math to ASCM training notes so the finance team speaks the same language; on the process side I hold pyrometry and instrumentation to SAE AMS 2750 when the job is aerospace or defense and I run those checks at Nadcap facilities, while my in-plant notes on Metal Forgings show why grouping like alloys on the same day protects die life and reduces heat loss between hits.

Heat Treatment & Inspection: How Do Specs Change Cost?

You can hit hardness and still fail stress or distortion if the route, the section size, or the quench choice does not fit the job.

Tighter heat-treat windows and harder inspection levels add soak time, straightening, and queue time; I choose the lowest-risk spec that still protects against the field failure we fear most and I cite public words so no one guesses later.

I normalize or quench-and-temper steels, I run solution-and-age on 17-4PH at a condition that balances strength and toughness, and I follow AMS or SAE routes for nickel and titanium with ovens and instruments aligned to SAE AMS 2750 and audits that trace back to Nadcap where the program demands it; after heat treat on thick sections I use UT per ASTM A388 to prove internal soundness, while for surface cracks I use MT per ASTM E1444 on ferromagnetic steels and penetrant from the same ASTM index on non-magnetic alloys, and I keep before-and-after photos on our Blog so a buyer can see why the inspection plan is not a guess.

Packaging & Logistics: How Does Shipping Shape Your Total Landed Cost?

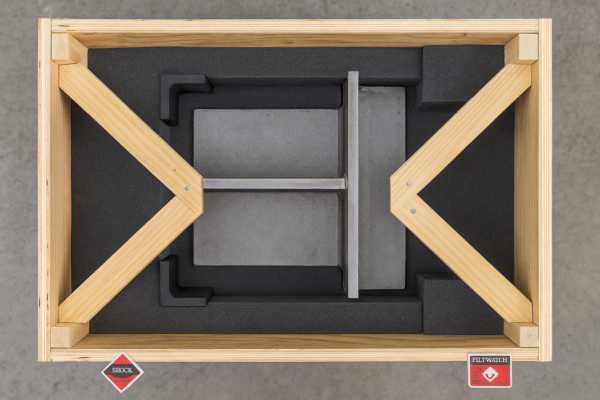

You can forge a perfect part and lose it in transit if the box crushes, the flange scuffs, or the label goes missing.

Strong packaging with VCI, blocking, and clear labels plus the right Incoterms avoids hidden costs; sea vs air is a value-of-time choice, and I align the rule set with the official words from the ICC.

I spec VCI wrap and desiccant for bare steel, I block and guard thin rims, I drop-test heavy stacks, and I write Incoterms on the PO using the official pages from the International Chamber of Commerce so freight, duty, and risk sit with the right party; when a buyer wants the best price, I show them how a furnace-filling batch and a standard crate pattern cut cost, and if they need parts fast I explain the expedite premium and link back to the cadence section and our Contact form so we can block a press window before it closes.

Supplier Quality & Payment Terms: Can You Cut Risk Without Overpaying?

A cheap unit price with weak systems costs more later than a slightly higher price with stable flow.

ISO-based systems, PPAP when needed, and simple SPC protect the program; payment terms tied to samples and milestones protect both sides, and I keep those rules visible before the PO.

I ask for an ISO 9001 certificate because the language is common and the audits are predictable on the ISO site, I use ASCM ideas for planning and inventory so releases match capacity, I align special processes to Nadcap when the contract calls for it, and I lean on NIST Manufacturing resources when we tune measurement or process capability; on the buyer side I tie tooling deposits to die design approval and T0 samples, I release balance at PPAP or after a rate run, and I keep that sentence right next to the scope when I send a quote through Contact so payment behavior supports delivery behavior.

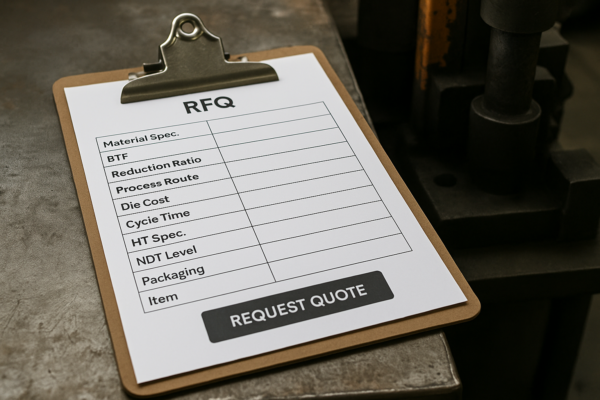

Cost Model & RFQ Checklist: How Do I Build a Quote That Wins?

A clean RFQ cuts noise because both sides see the same buckets and the same assumptions.

I break price into material, forging hours, tooling, heat treat, NDT, machining, finish, pack, and freight; I ask suppliers to state buy-to-fly, reduction ratio, inspection levels, and lead-time assumptions in writing.

I keep an internal one-pager that I can fill from the phone, I cite ASTM when I choose NDT, I cite SAE when I choose pyrometry or process specs, I link ASCM when I justify batch size, and I attach a short drawing markup from our Blog showing draft, radii, and stock so the forger knows I plan to machine only where it matters; when you send your CAD on Contact, I return two routes—“fast start” and “best total cost”—with the math behind each choice.

Real RFQ Case Studies: Three Parts, Three Cost Paths?

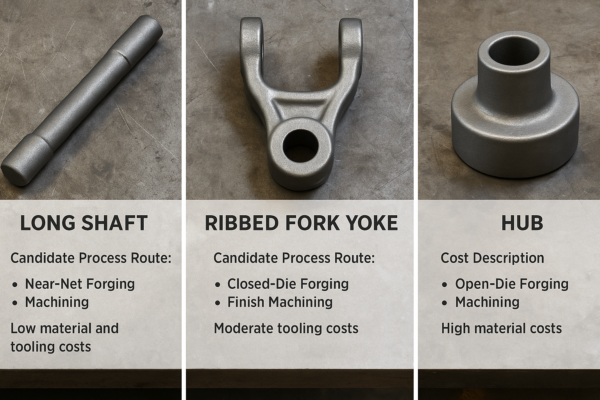

I keep three simple cases because they cover most of the arguments I see on the floor and in meetings.

A long shaft likes open-die and machining, a forked yoke likes closed-die hot forging, and a small wheel hub at volume can like cold forging; the winner moves with geometry, alloy, and batch size.

Shaft (4140, 60 pcs/year). I start with open-die cogging and draw because the part is long, the grain wants to be straight, and the die would not pay back; I leave 3–4 mm stock, I Q&T, and I finish with turn/grind, while a note to ASTM A388 on the print keeps UT clear and a link back to our Blog shows the turn sequences we use.

Yoke (17-4PH, 1,200 pcs/year). I choose closed-die with a preform that feeds the forks, I set 5–6° draft and 2–3 mm fillets on internal corners, I run solution + age at a condition that balances strength and toughness, and I mark PT in the notes with a link to the ASTM index so the acceptance is not a guess.

Hub (20MnCr5, 35,000 pcs/year). I price cold forging with forward and backward extrusion because the volume supports tools and the geometry supports flow, I grind bearing seats, I case harden, and I run MT on 100% after heat treat; if a buyer wants supplier breadth I share public overviews from FIA and I offer a second-source plan when they send a forecast on Contact.

FAQs

What is buy-to-fly (BTF), and why does it matter? BTF is the ratio of metal bought to finished mass, and it drives material spend and scrap; small changes in billet size, draft, or stock can swing BTF by double-digit percent, which is why I write “assumed BTF” into quotes and link forging basics from FIA beside our own notes on Metal Forgings.

How do I pick between open-die and closed-die for low volumes? If the part is simple and big and the run is under 30 pieces, I go open-die and machine; if it has ribs, pockets, or grain-flow needs, I cost a small closed die and check a break-even, and I keep ASM and FIA links in the deck so leadership sees the same logic.

Do stainless and nickel alloys cost more only because alloy price is higher? No; hotter furnaces, longer soaks, more scale, and more sticking add cost on top of the raw price, and ASM shows why flow stress and oxidation both climb with temperature.

What reduction ratio should I put on the print? I use 3:1 on general parts and 4:1–6:1 on fatigue-critical parts, and I align NDT gates to ASTM A388 and E1444 so “sound” has a shared meaning.

Can cold forging replace machining? Often yes on small and mid-size steel parts when the shape fits, but it needs press power, lube chemistry, and tougher tools; I tie the decision to volume using ASCM logic and I put the trade on our Blog for the wider team.

How much draft do I need? I use 3–7° on hot closed-die surfaces and I may use 2–3° on easy externals with a light finish cut, while internal pockets want more; the pictures from FIA end most debates.

Which NDT method should I choose? For ferromagnetic steels I use MT per ASTM E1444; for internal soundness in steel forgings I use UT per ASTM A388; for non-magnetic alloys I use penetrant from the same ASTM index, and I show examples on our Blog.

What drives heat-treat cost the most? Load utilization, cycle length, and distortion risk drive cost, while pyrometry discipline under SAE AMS 2750 and audit alignment under Nadcap keep special processes stable.

How do packaging choices affect landed cost? VCI, blocking, and label clarity prevent damage and claims, while sea vs air and the risk split under Incoterms move cash between parties; I design the pack in the RFQ and I keep photos on our Blog.

Author Bio & Editorial Standards

I write as a buyer, a plant guy, and a supplier; I started on the floor in the 1990s, I learned dies and flow before I learned PowerPoint, I led PPAP, ISO, and Nadcap work through real ship dates, and I keep this guide honest by linking public standards from ISO, ASTM, SAE, FIA, ASCM, and NIST right next to our in-house practice on Prime Custom Parts so you can click both and judge me.

Conclusion

Control buy-to-fly and cadence, use radii and real draft, match process to volume, and freeze the spec early; if you want me to mark your print today, send it through Contact and I will return two cost paths with the assumptions in writing.

My Role

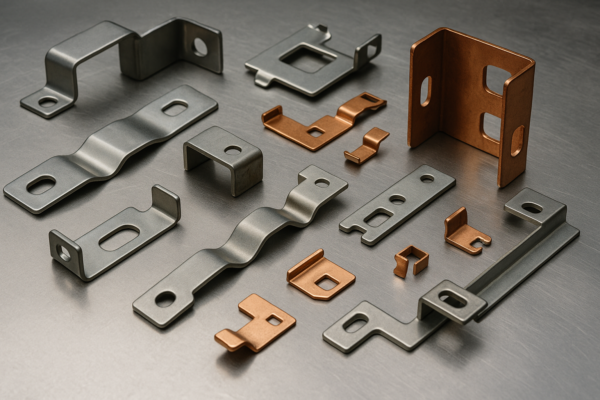

At Prime I run one-stop metal parts programs with stamping, welding, forging, casting, CNC, and fasteners under an ISO-aligned system that fits ISO 9001 language, I plan batches with ASCM logic, I align heat treat and special processes to SAE and Nadcap expectations when a contract demands it, and I publish practical checklists on our Blog so buyers and engineers can move faster without losing control; if you need pricing, dates, or a drawing markup, start on Prime Custom Parts and send the RFQ on Contact so I can tie your needs to the right press window.