Top Custom Forging Suppliers in China: Quality, Capacity, and Turnaround

Introduction

China has become a leading destination for custom forging, driven by competitive pricing, advanced manufacturing, and export readiness. As global supply chains adapt to demand for quality parts at speed, more engineers and procurement teams turn to Chinese suppliers.

This guide examines the largest global forge leader, the types of forging processes, market dynamics in the U.S., and the future of forging. We’ll also highlight top Chinese suppliers—especially Shandong Prime International—and provide a practical sourcing checklist.

Keywords like “custom forging China,” “precision metal forging supplier,” and “turnkey forging solutions” are embedded for SEO value and to align with buyer search intent.

1. Which is the Largest Forging Company in the World?

The title of the world’s largest forging company goes to Bharat Forge, headquartered in Pune, India. It dominates through scale, technology, R\&D, and certification standards.

A. Company Profile & Scale

- Founded: 1961

- Revenue: \~\$1.5 billion in 2024

- Employees: 17,000+ globally

- Global Facilities: 14 plants (India, USA, Germany, UK)

- Main Industries: Automotive, aerospace, industrial machinery, oil & gas, defense

B. Technical Capabilities

- Heavy presses up to 12,000 kN for large forgings

- Advanced ring rolling lines for flanges and turbine disks

- CNC machining, heat treatment, NDT, metallurgy labs for one-stop delivery

C. Certifications & R\&D

- ISO 9001, IATF 16949, NADCAP approvals

- In-house testing using ultrasonic, dimensional, metallographic methods

- Over 100 patents; ongoing partnerships with MIT and IIT research teams

D. Why It Matters

Large capacity enables economies of scale. Global footprint facilitates regional delivery. R\&D ensures technical superiority—key for high-reliability sectors like aerospace.

2. What Are the 4 Types of Forging?

Choosing the correct forging method is crucial—it directly impacts part accuracy, cost, and lead time.

1. Open‑Die Forging

- Process: Deforming metal between flat or simple dies

- Ideal For: Large shafts, blocks, discs

- Tolerances: ±0.5 mm

- Cost: Low tooling cost, flexible for low volumes

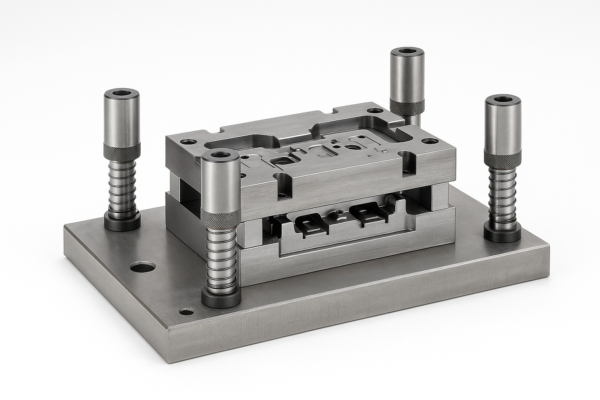

2. Closed‑Die (Impression‑Die) Forging

- Process: Metal is forged between shaped dies

- Ideal For: Gears, hubs, levers

- Tolerances: ±0.1 mm

- Cost: Higher tooling cost; cost-effective at scale

3. Rolled‑Ring Forging

- Process: Forming ring blanks on a ring mill

- Ideal For: Bearings, flanges, wind turbine rings

- Tolerances: ±0.3 mm

- Strength: High integrity and grain structure

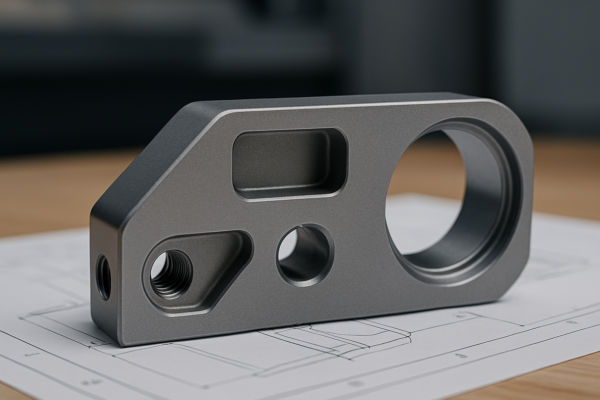

4. Press or Precision Forging

- Process: High-speed hydraulic/mechanical presses

- Ideal For: Aerospace parts, drivetrain components

- Tolerances: ±0.05 mm

- Cost: High tooling and machinery investment, offset by precision

| Forging Type | Application | Tolerance | Tooling Cost |

|---|---|---|---|

| Open‑Die | Large shafts, industrial parts | ±0.5 mm | Low |

| Closed‑Die | Gears, connectors, flanges | ±0.1 mm | High (scale) |

| Rolled‑Ring | Bearings, turbine rings | ±0.3 mm | Medium |

| Press/Precision | Engine/aerospace components | ±0.05 mm | High |

3. How Big is the Forging Market in the U.S.?

The U.S. forging industry is robust and diverse, serving both mature and emerging markets.

A. Market Size & Prospects

- 2023 Market Size: \$12.74 billion

- 2030 Forecast: \$21.29 billion at \~7.6% CAGR (Source: MarketsandMarkets)

- Global share: \~14–25% of worldwide forging revenues

B. Major Demand Sectors

- Automotive & EV: Lightweight suspension, hubs

- Aerospace: Discs, shafts, landing gear

- Oil & Gas: Valves, pipes, drill casings

- Construction Machinery: Hydraulic components

- Defense & Medical: Armaments, surgical instruments

C. Market Trends

- Increasing emphasis on EV applications

- Re-shoring of critical metal part production

- Demand for smart, traceable, and compliant components

4. What is the Future of Forging?

Forging is transforming to meet modern manufacturing demands through four key trends:

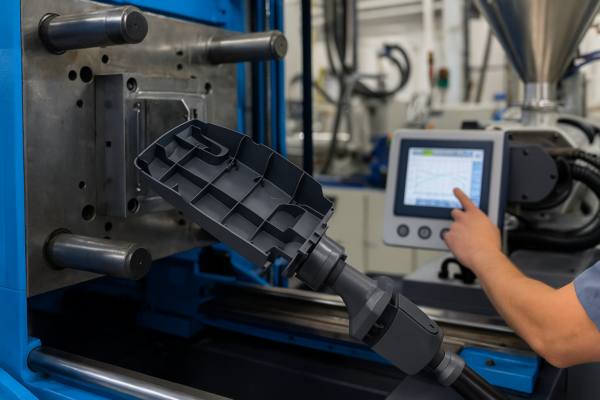

A. Automation

- Robotic part handling, flash removal, die changing

- Smart presses auto-adjust force within milliseconds

- Example: Thyssenkrupp Forging’s smart cells

B. Digitalization & IIoT

- Sensors for die condition, temperature, load

- MES data recording with full traceability

- Digital twins replicate forging for testing

- AI predicts tool wear and adjusts process conditions

Example: Farinia Group uses AI insights for zero-defect targets.

C. Lightweight & High-Strength Alloys

- Aerospace-grade Ti-6Al-4V

- 6000/7000 series aluminum for EV

- 17-4PH, Duplex stainless steels for corrosion-critical parts

These alloys require clean rooms, inert atmosphere heating, longer cycle times.

D. Sustainability & Green Manufacturing

- Induction heating reduces CO₂ by 20–30%

- On-site solar and hydro initiatives in forging plants

- Closed-loop scrap recycling and heavy re-use

- External data: IEA’s Net Zero by 2050 summary (link)

"Smart manufacturers reduce scrap by 20% and cut unplanned downtime by 15%." — Forbes on smart manufacturing (Nov 2023) (link)

5. China’s Turnkey Forging Suppliers: Focus on Prime

A. Industry Context

China is a global hub for custom forging—its export success depends on:

- Low-cost high-volume capacity

- Increasing adoption of automation and quality systems

- Strong export infrastructure and logistics

B. Prime’s Competitive Strength

Shandong Prime International stands out with:

- 10 advanced production lines integrating forging, CNC, and stamping

- Systems certified to ISO 9001 and RoHS

- Service range: open-die, closed-die, rolled-ring and press components

- In-house QA labs: CMM, hardness, microstructure testing

- MOQ flexibility down to 100 pcs

- Typical lead time: 30–45 days for custom parts + tooling

- Export partners: USA, EMEA, Australia, South America

Prime meets major standards with proprietary ERP, MES, and digital traceability across orders.

C. Supplier Comparison in China

While Bharat Forge dominates globally, top Chinese competitors like Jinan Foundry Group, China FAW, and others often focus on volume. Prime’s edge lies in quality-control, digital readiness, and tailored services.

6. Conclusion & Action Plan

Forward-looking buyers now require more than low-cost forging—they demand precision, compliance, and agility. Here’s a detailed action plan:

- Process Alignment: Match part design and tolerances to forging method

- Certify Checks: Verify ISO 9001, IATF 16949, RoHS, etc.

- Digital & Green Scorecard: Evaluate automation, IIoT adoption, energy practices

- Material & Alloy Verification: Ensure alloy chemistry and material tests meet spec

- Export Readiness: Confirm logistics, crate quality, customs support

Why Choose Prime?

Prime provides turnkey leading-edge forging services:

- Precision forging and CNC finishing under one roof

- Full certification and quality documentation

- Global shipping & communication capability

- Flexible MOQ and committed lead times

- CAD optimization, packaging recommendations, and technical guidance

📧 Contact: [email protected]

🌐 Website: https://primecustomparts.com

Get a free consultation, custom tooling quote, and complete logistics package tailored to your project.

FAQs

Q1: What’s the minimum order for custom forgings?

A: Typically 100–500 pcs, depending on forging type and die cost.

Q2: How are forged parts tested?

A: Through dimensional measurement (CMM), hardness, metallography, ultrasonic NDT.

Q3: Are bespoke alloys available?

A: Yes—Prime, Bharat Forge, and other OEMs support custom alloy formulation and trace heat codes.

Q4: What are lead times?

A: Crafting tooling often takes 4–8 weeks. Small batch manufacturing runs in 30–45 days.

Q5: Do you support third-party inspection?

A: Yes—clients can engage SGS, BV, TUV, or Intertek for on-site inspections.