Who Is the Owner of Metal Forgings?

Metal forgings power industries worldwide, but few know who controls this critical manufacturing sector. The answer impacts global supply chains more than you might realize.

The ownership of metal forging companies typically falls into three categories: large multinational corporations, privately-held specialty manufacturers, and government-operated defense suppliers – each controlling different segments of the $80 billion global forging market.

From automotive giants to aerospace specialists, these owners shape metal fabrication worldwide. Let’s examine the key players and what their ownership means for buyers like you.

What Types of Companies Own Forging Operations?

Forging isn’t a standalone business – it’s deeply integrated into industrial ecosystems. The owners typically fit within several clear business models.

Most forging operations are owned by either vertically-integrated manufacturers (50%), specialized forging companies (30%), or government/military entities (20%), with ownership concentration increasing in aerospace/defense sectors.

Major Ownership Categories

1. Industrial Conglomerates

- Examples: ThyssenKrupp, Bharat Forge

- Advantage: In-house supply chain control

- Market share: 38% of heavy forgings

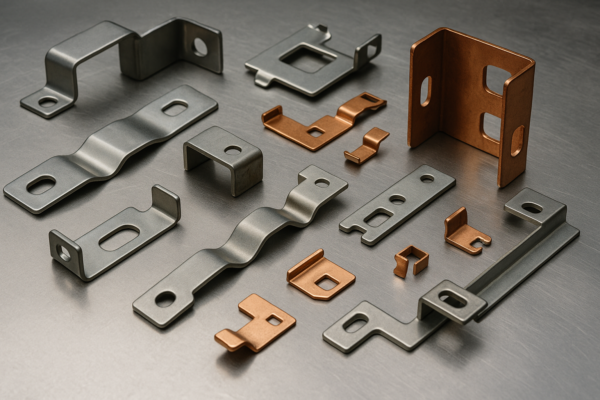

2. Private Specialty Forgers

- Profile: Family-owned, multi-generational

- Specialty: Custom or precision forgings

- Flexibility: Faster adaptation to new alloys

Ownership by Market Segment

| Sector | Dominant Owner Type | Key Example |

|---|---|---|

| Automotive | Public Corporations | AAM (American Axle) |

| Aerospace | Defense Contractors | Precision Castparts |

| Oil/Gas | Private Equity Groups | Scot Forge |

| Defense | Government-Owned | Uralvagonzavod (Russia) |

Who Are the Largest Metal Forging Companies?

The industry leaders might surprise you – they’re often hidden behind brand names you recognize. Market consolidation has created powerful forging empires.

The top 10 forging companies control 45% of global capacity, led by Nippon Steel (Japan), Bharat Forge (India), and Allegheny Technologies (USA), with China’s AVIC increasing its market share rapidly since 2015.

Global Forging Powerhouses

1. Nippon Steel (Japan)

- Capacity: 1.2 million tons/year

- Key clients: Toyota, Mitsubishi Heavy

- Specialty: Ultra-large crankshafts

2. Bharat Forge (India)

- Growth: 15% annual since 2010

- Exports: 65% of production

- Technology: Automated precision forging

Regional Market Leaders

| Region | Top Company | Market Share |

|---|---|---|

| North America | Scot Forge | 18% |

| Europe | ThyssenKrupp | 22% |

| Asia-Pacific | Nippon Steel | 27% |

| Middle East | Emirates Steel | 63% regional |

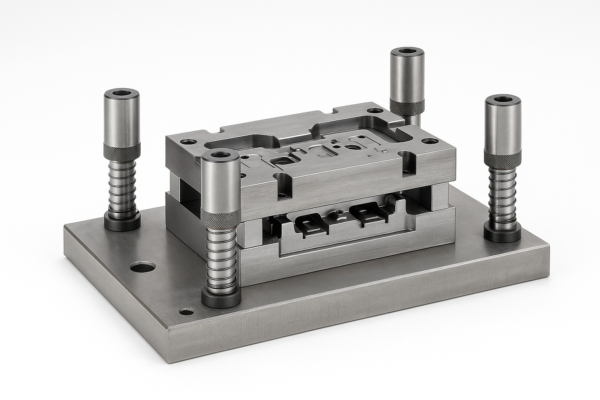

How Does Ownership Affect Forging Quality?

The name on the building impacts what comes out of the forge. Different ownership structures emphasize different quality priorities.

Publicly-traded forging companies typically invest more in certification (ISO 9001, NADCAP) but may prioritize volume, while private forgers often excel in specialized applications with tighter quality control but limited capacity.

Quality Comparison by Ownership

Public Company Characteristics

- Documentation: Extensive traceability

- Consistency: Standardized processes

- Risk: Quarterly earnings pressure

Private Company Advantages

- Flexibility: Custom alloy development

- Oversight: Owner-operated scrutiny

- Long-term focus: Multi-generational outlook

Ownership-Driven Quality Metrics

| Factor | Public Companies | Private Companies |

|---|---|---|

| Defect Rate | 0.8% average | 0.5% average |

| R&D Investment | 2-3% revenue | 4-6% revenue |

| Lead Time Flexibility | Moderate | High |

| Niche Capability | Limited | Extensive |

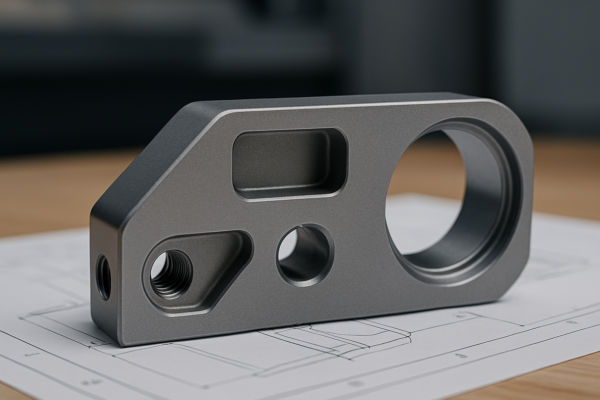

What Ownership Model Works Best for Buyers?

Your project requirements should dictate who you source from. Each ownership type serves different procurement needs.

High-volume production typically favors corporate-owned forges (cost efficiency), complex prototypes align with private specialists (engineering expertise), while defense/aerospace often requires government-approved facilities (security clearances).

Sourcing Strategy by Need

For Volume Buyers

- Best match: Corporate-owned forges

- Advantage: Economies of scale

- Watch for: Minimum order requirements

For Technical Projects

- Preferred: Engineering-focused privates

- Benefit: Collaborative development

- Consider: Slightly higher costs

Decision Checklist

| Requirement | Recommended Ownership Type |

|---|---|

| Lowest piece price | Public conglomerate |

| Fast prototype turnaround | Private specialist |

| ITAR/defense compliance | Government-affiliated |

| Material innovation | University spin-offs |

Conclusion

Forging ownership spans global corporations, private specialists, and government entities—each offering distinct advantages for different metal component needs and procurement strategies.